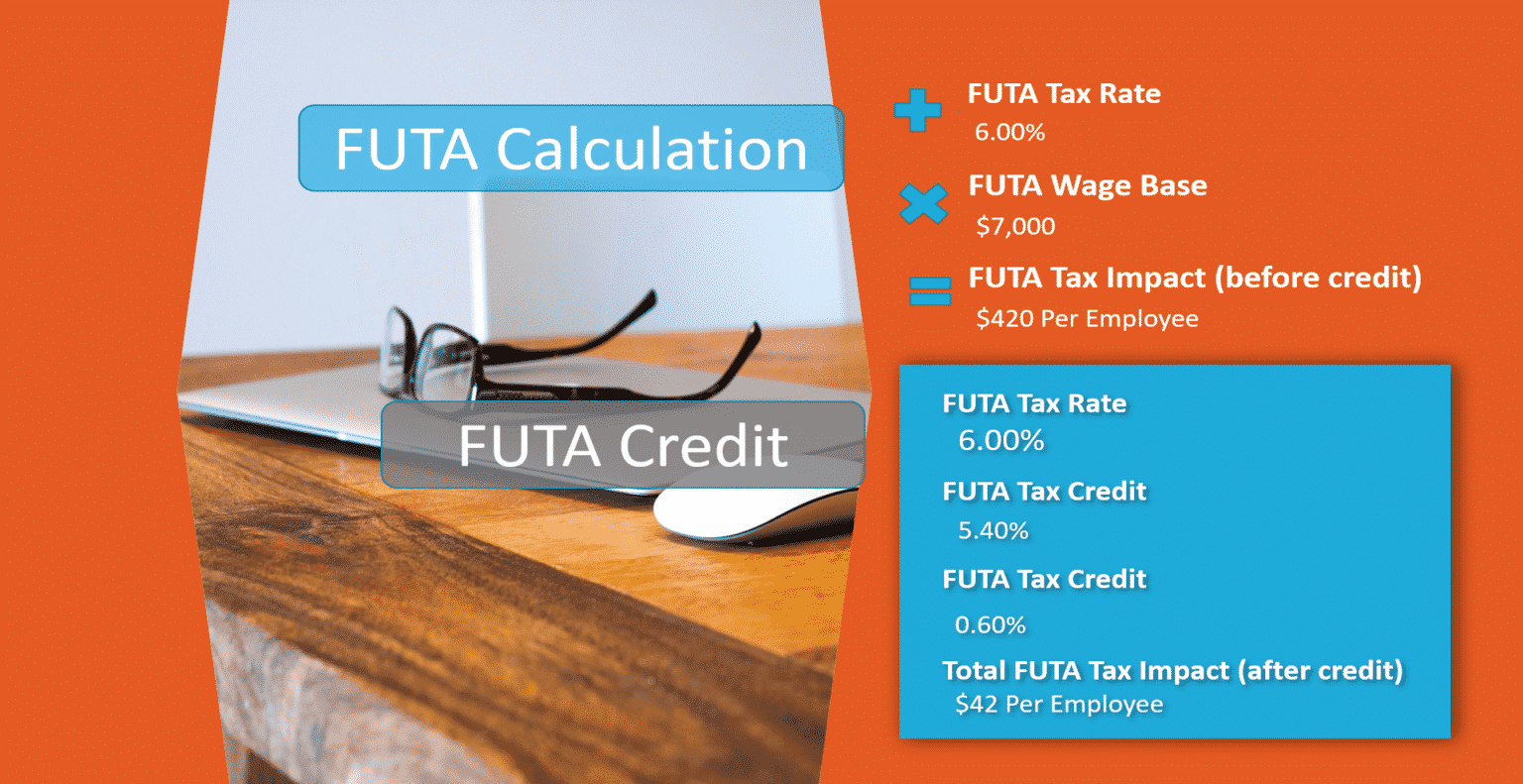

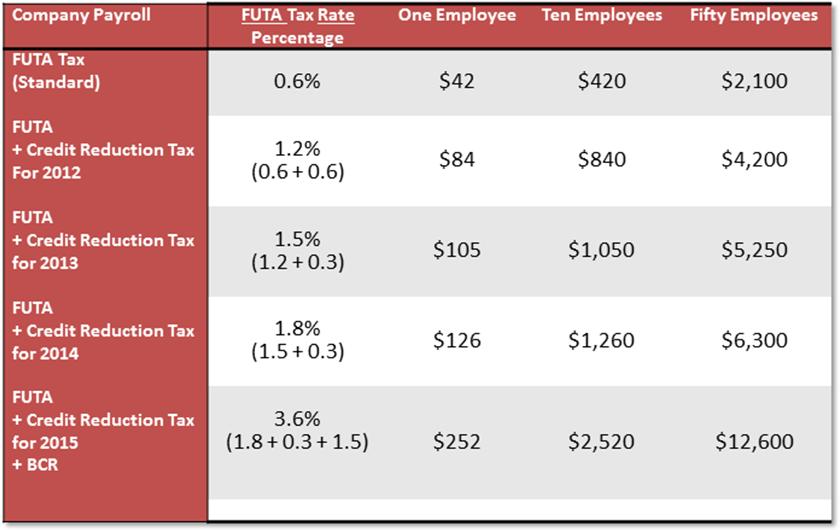

Maximum Futa Tax 2024. Employee 3 has $37,100 in eligible futa wages, but futa applies. Futa tax is effectively 0.6% of the first $7,000 paid to each employee (except for ca, ct, and ny, which charge 0.15%).

Therefore, employers shouldn’t pay more than $420 annually for each. Futa liability = (employee a’s eligible wages + employee b’s eligible wages) x 6%.

Find Federal Unemployment Tax Act (Futa) Tax Filing And Reporting Information Applicable To U.s.

Therefore, employers shouldn't pay more than $420 annually for each.

2024 As Of January 16, 2024.

The basic futa rate is 6%.

Your Credit For 2024 Is Limited Unless You Pay All The.

Images References :

Source: accuservepayroll.com

Source: accuservepayroll.com

What is FUTA? Federal Unemployment Tax Rates and Information for 2022, The basic futa rate is 6%. The futa tax rate for 2024 is 6.0%.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is FUTA? Definition & How it Works QuickBooks, The futa tax rate for 2024 is 6.0%. The federal unemployment tax act (futa) establishes a payroll tax, known as the futa tax, that employers must pay.

Source: ifunny.co

Source: ifunny.co

FUTA Federal Unemployment Tax Act What is FUTA? The Federal, For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the. 2024 as of january 16, 2024.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

FUTA Taxes & Form 940 Instructions, How to calculate your futa obligation. This applies to the first $7,000 paid to each employee as wages during the year.

Source: fmpglobal.com

Source: fmpglobal.com

What Is FUTA? The Federal Unemployment Tax Act Explained, Futa tax is effectively 0.6% of the first $7,000 paid to each employee (except for ca, ct, and ny, which charge 0.15%). What this means is that in january,.

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, The standard futa tax rate is 6.0% on the first $7,000 of taxable wages per employee, which means that the maximum tax that you as an employer have to pay per employee. Find federal unemployment tax act (futa) tax filing and reporting information applicable to u.s.

Source: www.yourfundingtree.com

Source: www.yourfundingtree.com

FUTA Tax Rate Discover What It Is and How It Works, The futa tax liability is based on $17,600 of employee earnings ($4,900 + $5,700 + $7,000). 2023 $ 2024 $ increase or decrease.

Source: www.accuchex.com

Source: www.accuchex.com

FUTA Tax Calculation Accuchex, It mandates employers to pay unemployment futa tax to fund state unemployment programs. Futa tax is effectively 0.6% of the first $7,000 paid to each employee (except for ca, ct, and ny, which charge 0.15%).

Source: www.taxuni.com

Source: www.taxuni.com

FUTA Tax Rate 2024, What is the futa tax rate? The 2024 futa tax rate is 6% of the first $7,000 from each employee's annual wages.

Source: www.fundera.com

Source: www.fundera.com

What Is FUTA Tax Tax Rates and Information, 1.45% for the employee plus. 2024 as of january 16, 2024.

This Brings The Net Federal Tax Rate Down To.

What this means is that in january,.

The 2024 Futa Tax Rate Is 6% Of The First $7,000 From Each Employee's Annual Wages.

1.45% for the employee plus.