Inheritance Tax Return 2024. An inheritance tax is a tax beneficiaries pay when they inherit assets from someone who has died. Kit sproson | edited by ben slater.

The income tax department periodically updates tax return forms to gather additional information from taxpayers. From 6 april 2024, if the estate’s income from any sources is less than £500, you do not need to report the estate to hmrc.

Last Updated 28 February 2024.

From 18 january 2024, customers applying for probate in england and wales no longer need to complete an iht421 probate.

If This Happens, The Legal Personal Representative (Lpr) Of The.

Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount.

Inheritance Tax Return 2024 Images References :

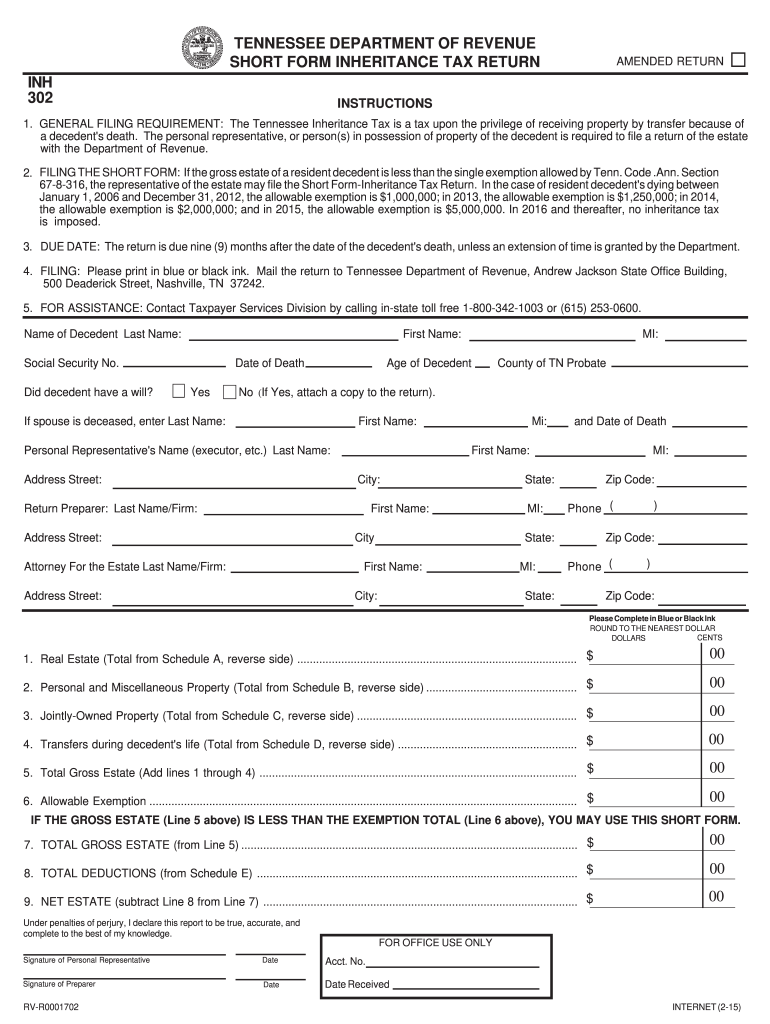

Source: www.signnow.com

Source: www.signnow.com

Department Revenue Inh 20152024 Form Fill Out and Sign Printable PDF, Who has to pay inheritance taxes?. Read the guidance on valuing the estate of someone who’s died before you use these forms.

Source: www.zrivo.com

Source: www.zrivo.com

Kentucky Inheritance Tax 2024, You need to download and complete a paper copy of form iht205 to report the value of an estate. Is inheritance tax levy feasible in india?

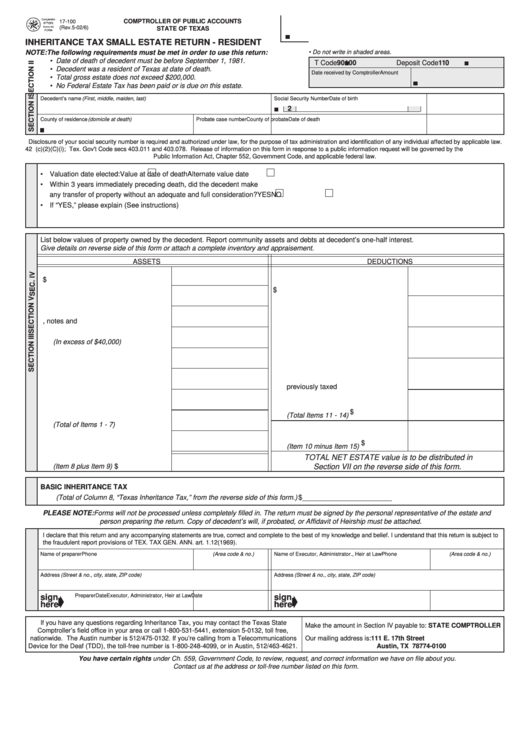

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 17100 Inheritance Tax Small Estate Return Resident, Is inheritance tax levy feasible in india? Last updated 28 february 2024.

Source: www.pdffiller.com

Source: www.pdffiller.com

Nj Inheritance Tax Non Resident Return Fill Online, Printable, State inheritance tax rates range from 1% up to 16%. The income tax department periodically updates tax return forms to gather additional information from taxpayers.

Source: www.dochub.com

Source: www.dochub.com

Affidavit of inheritance washington state Fill out & sign online DocHub, Read the guidance on valuing the estate of someone who’s died before you use these forms. The uk raised less from inheritance and gift taxes in 2022 than the us, japan, france or germany.

Source: corlisswjade.pages.dev

Source: corlisswjade.pages.dev

California Estate Tax Exemption 2024 Lanny Modesty, Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary.

Source: www.youtube.com

Source: www.youtube.com

15 Ways to Avoid Inheritance Tax in 2024 YouTube, This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. When one inherits any asset in india by way of.

Source: www.linkedin.com

Source: www.linkedin.com

Inheritance Tax in UK, An inheritance tax requires beneficiaries to pay taxes on assets and property they’ve inherited from someone who has died. If you become presently entitled to income of the deceased estate, you need to include it in your tax return.

Source: www.slideshare.net

Source: www.slideshare.net

Inheritance tax account 0 iht400 by Keyconsulting UK, Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount. Anant jain & suraj malik.

Source: disciplineinfluence28.gitlab.io

Source: disciplineinfluence28.gitlab.io

Great Tax Computation Sheet In Excel Format Stakeholder, The good news for beneficiaries in 2024 is that the tax implications are generally favorable. Sometimes known as death duties.

For Every Tax Year Of The.

Inheritance tax and applying for probate.

Last Updated 28 February 2024.

Read featherstone’s comprehensive iht guide to navigating inheritance tax rules and regulations and how to minimise your tax burden in 2024.

Category: 2024