How Much Mortgage Interest Is Tax Deductible 2024. Here are some changes you need to know for tax season. In 2022, the standard deduction is $25,900 for married couples filing jointly and $12,950 for individuals.

You can deduct mortgage interest on a loan for up to $750,000 of principal. Mortgage interest tax deduction limit.

The Tax Deduction Also Applies If You Pay Interest On A.

For married couples filing separately, that limit is $375,000.

The Tax Cuts And Jobs Act (Tcja), Which Is In Effect From 2018 To 2025, Allows Homeowners To Deduct Interest On.

So let’s say you purchased a home.

Married Taxpayers Filing Separately Can Deduct Up To.

The minimum income to file taxes depends on your filing status, age and tax year.

Images References :

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction With TaxSlayer, You deduct 25% ($25,000 ÷. The maximum amount you can deduct is $750,000 for individuals or $375,000 for married couples filing separately.

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction The Official Blog of, The child tax credit can provide a $2,000 discount on taxes for each. The deduction is only available for interest paid on the first $750,000 of your mortgage debt.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

How Much Mortgage Interest Can You Claim On Taxes Tax Walls, For tax years 2018 through 2025, the deduction is limited to interest paid on the first $750,000 of mortgage debt ($375,000 for married filing separately), which. 15, 2017, you are allowed to deduct mortgage interest on home loans up to $750,000.

Source: investguiding.com

Source: investguiding.com

Investment Expenses What's Tax Deductible? (2024), The maximum amount you can deduct is $750,000 for individuals or $375,000 for married couples filing separately. The child tax credit can provide a $2,000 discount on taxes for each.

Source: www.forbes.com

Source: www.forbes.com

How To Qualify For Mortgage Interest Deduction for 2024 Forbes Advisor, The home mortgage interest deduction (hmid) allows homeowners who itemize on their tax returns to deduct mortgage interest. If you are single or married and filing jointly, and you’re itemizing your tax deductions, you can deduct the interest on mortgage debt up to $750,000.

Source: themortgagereports.com

Source: themortgagereports.com

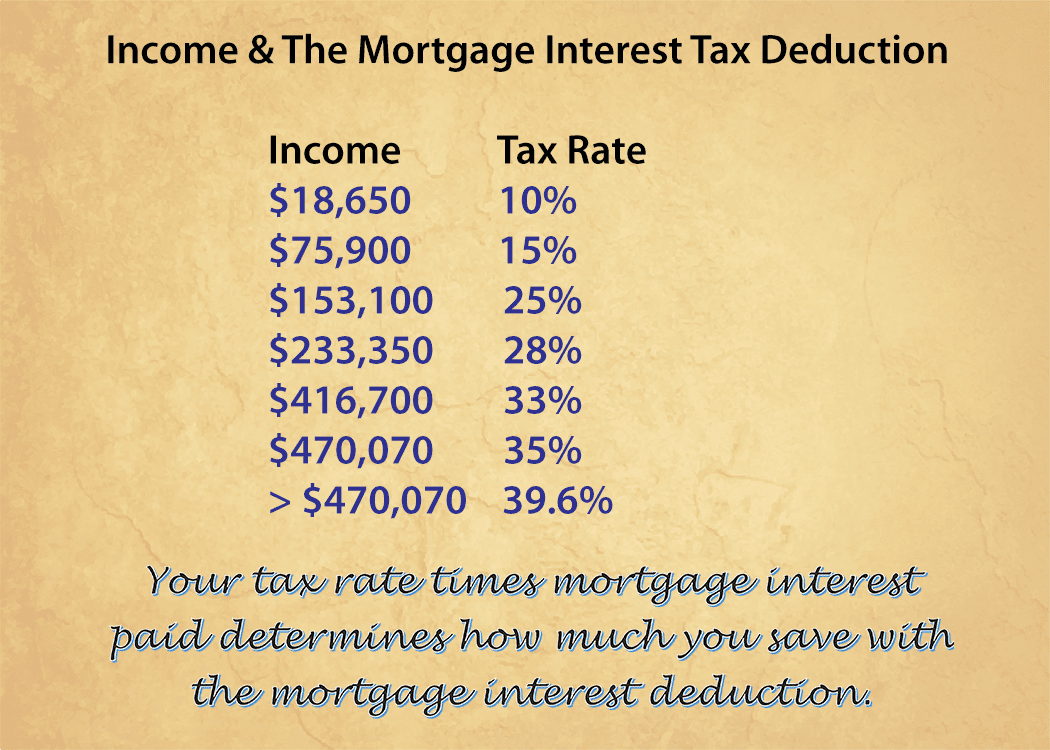

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage, Most homeowners can deduct all of their mortgage interest. The home mortgage interest deduction (hmid) allows homeowners who itemize on their tax returns to deduct mortgage interest.

Source: www.homeswithneo.com

Source: www.homeswithneo.com

When Is Mortgage Interest Tax Deductible?, If you paid more than $600 in mortgage interest last year, keep an eye out for a form 1098 from your mortgage lender in the coming weeks, (early 2024). The standard deduction is $19,400 for those filing as head.

Source: tradymoney.com

Source: tradymoney.com

Mortgage Interest Tax Deductible 2023, This means you'll only pay taxes on $100,000 of your. The facts are the same as in example 1, except that you used $25,000 of the loan proceeds to substantially improve your home and $75,000 to repay your existing mortgage.

Source: www.pinterest.com

Source: www.pinterest.com

How the Mortgage Tax Deduction Works FREEandCLEAR Mortgage process, As of the 2022 tax year, the irs allows single and married taxpayers filing jointly to deduct interest on up to $750,000 for mortgages taken out after december 15, 2017 (after the. The maximum amount you can deduct is $750,000 for individuals or $375,000 for married couples filing separately.

Source: orchard.com

Source: orchard.com

Is Mortgage Interest Tax Deductible in 2023? Orchard, For anyone who purchased a home after dec. In 2017, the tax cuts and jobs act (tcja) actively modified personal income taxes.

You Can Deduct The Mortgage Interest You Paid During The Tax Year On The First $750,000 Of Your Mortgage Debt For Your Primary Home Or A Second Home.

So let's say you purchased a home.

Associate Finance Minister David Seymour Said In A Statement Landlords Will Be Able To Claim 80 Percent Of Their Interest Expenses From April 1 2024 And 100 Percent.

The deduction is only available for interest paid on the first $750,000 of your mortgage debt.

If You Paid More Than $600 In Mortgage Interest Last Year, Keep An Eye Out For A Form 1098 From Your Mortgage Lender In The Coming Weeks, (Early 2024).

The facts are the same as in example 1, except that you used $25,000 of the loan proceeds to substantially improve your home and $75,000 to repay your existing mortgage.

Category: 2024